Ethereum Correction Over? Binance Funding Rates Signal ETH Surging To $6,800

Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) may be nearing the end of its price correction, as the second-largest cryptocurrency by market cap continues to trade slightly above $4,000, following a strong sell-off last week when it almost crashed to $3,400.

Ethereum Price Correction May Be Over

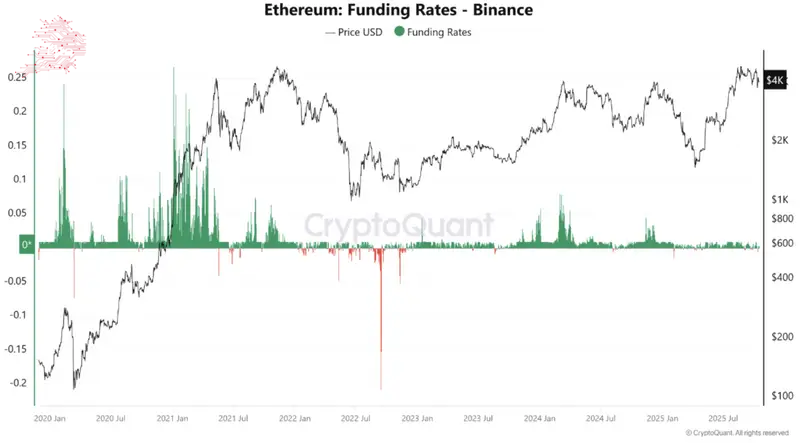

According to a CryptoQuant Quicktake post by contributor PelinayPA, Ethereum funding rates on Binance crypto exchange have remained positive, despite being in a narrow range. This shows that long positions on ETH still dominate the market.

ETH funding rates fluctuating normally on Binance – despite the digital asset’s recent extraordinary price appreciation – implies that futures traders are not exhibiting greed or euphoria, typically associated with the mid-phase of a healthy uptrend.

For example, during the 2021-22 bull cycle, ETH funding rates often surged to 0.1% to 0.2%, aligning with local market tops. At present, these funding rates are hovering around 0.01% to 0.03%, implying that the market has not reached overheated levels just yet.

In addition, the absence of negative funding rates confirms a decline in short positioning, and elevated risk appetite among investors. The CryptoQuant analyst added:

The overall trend remains upward. Low funding rates combined with strong price momentum suggest that the correction is likely complete. In the short term, minor profit-taking or sideways consolidation between $3,600–$3,800 would be natural. If funding rates gradually rise above 0.05%, it could signal overcrowded longs and trigger a short term pullback.

The current combination of moderate levels of leverage and gradually rising spot demand hints toward a potential ETH rally, eyeing the $4,500 to $5,000 range in the long term. The price target could be even higher with a favorable derivatives structure and funding dynamics.

That said, a sharp increase in funding rates could be seen as an early warning of another price pullback for the cryptocurrency. However, ETH’s market structure still supports a potential surge to $6,800 by the end of 2025, the analyst concluded.

ETH Ready For New Highs?

Several indicators point toward ETH looking to resume its bullish momentum. For instance, ETH’s Spent Output Profit Ratio (SOPR) trend recently hinted toward the digital asset rising to $5,000 in the near term.

Further, ETH exchange reserves continue to tumble at a rapid pace. Recent exchange data shows that ETH reserves on exchanges have hit a multi-year low, raising the possibility of an impending “supply crunch” for the cryptocurrency.

That said, there are several other factors that may fuel another sell-off in ETH, pushing its price again below $4,000. At press time, ETH trades at $4,053, up 0.2% in the past 24 hours.

Nhận xét

Đăng nhận xét