Gold Soars Past $4k, Bitcoin Slides As Peter Schiff Warns Crypto ‘About To Be Rugged’

The gold price surged past $4k per ounce as Bitcoin tumbled more than 1% and Peter Schiff said the crypto market is “about to be rugged by gold.”

Gold hit a new all-time high (ATH) at $4,039.13 after surging over 53% this year and doubling in the past two years, according to TradingView.

Gold price per ounce (Source: TradingView)

But Bitcoin, sometimes likened to digital gold, was down 1.3% at $122,475 as of 4:37 a.m. EST, according to CoinMarketCap.

“Wall Street is so bullish on crypto that it’s hard to imagine it going much higher from here,” Schiff wrote on X. “Instead, it’s very likely that Bitcoin and everything crypto are about to be rugged by gold.”

Wall Street is so bullish on crypto that it’s hard to imagine it going much higher from here. Instead, it’s very likely that Bitcoin and everything crypto are about to be rugged by gold. As gold tops $4k, it’s likely that Bitcoin will sell off, taking the rest of crypto with it.

— Peter Schiff (@PeterSchiff) October 7, 2025

Schiff’s prediction of a broader market sell off comes a day after he warned Bitcoin investors not to get too excited about the crypto’s new record price. He said that in terms of gold, BTC is “still about 15% below its record high.”

Bitcoin also made a new high today, trading above $126K. But it terms of gold, it's still about 15% below its record high. I still think it's too early for Bitcoiners to get excited about the rally. Until Bitcoin can make a new high priced in gold, it's just a bear market rally.

— Peter Schiff (@PeterSchiff) October 6, 2025

“Until Bitcoin can make a new high priced in gold, it’s just a bear market rally,” he wrote in the post.

He also said that BTC would need to rise to about $148K to close its deficit to gold, but noted that “it’s a moving target as gold keeps rising.”

Author Adam Livingston also reminded investors in an Oct. 7 X post that BTC has not yet surpassed its 2021 ATH price in gold, adding that “the bull run hasn’t even started yet” and predicting that Bitcoin “is going to MELT FACES” in the final quarter of the year.

Bitcoin Could Be Worth Half Of Gold’s Market Cap After Next Halving, Says VanEck

Livingston is not alone in his bullish outlook for the crypto. VanEck’s head of digital asset research Mathew Sigel is also bullish on Bitcoin, but with a longer-term investment horizon.

In a recent X post, Sigel predicted that BTC could capture half of gold’s capitalization after the next halving event, which is slated for 2028.

“We’ve been saying Bitcoin should reach half of gold’s market cap after the next halving,” Sigel wrote.

We’ve been saying Bitcoin should reach half of gold’s market cap after the next halving. Roughly half of gold’s value reflects its use as a store of value rather than industrial or jewelry demand, and surveys show younger consumers in emerging markets increasingly prefer Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) October 7, 2025

He said that gold’s value reflects its use case as a store of value, but noted that surveys show younger investors, especially in emerging markets, prefer Bitcoin for this role.

“At today’s record gold price, that implies an equivalent value of $644,000 per BTC,” he added.

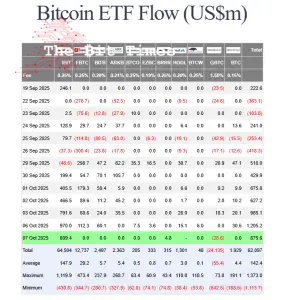

Strong Spot Bitcoin ETF Flows Persist, Led By BlackRock

While Schiff might be bearish on Bitcoin, institutional investors continue to buy into the crypto via spot ETFs (exchange-traded funds).

The funds started the week strong, and pulled in over $1.205 billion on Oct. 6, data from Farside Investors shows. This was their second-highest net daily inflows since their inception at the start of 2024.

US spot BTC ETF flows (Source: Farside Investors)

BlackRock’s spot Bitcoin ETF (IBIT) experienced the majority of those inflows, with $970 flowing into the fund on the day.

In the latest trading session, another $875.6 million flowed into the US spot Bitcoin ETFs. IBIT once again posted the highest inflows, with $899.4 million being added to the product’s reserves yesterday.

The only other fund to record net daily inflows in the latest trading session was Valkyrie’s BRRR. Meanwhile, Grayscale’s GBTC recorded $28.6 outflows.

IBIT has been the preferred US spot Bitcoin ETF for investors, and has become the most profitable BlackRock ETF. The fund is also closing in on $100 billion in assets.

Related Articles:

- European Union Mulls Sanctions On Russian Ruble-Backed A7A5 Stablecoin

- ETH Value Has “Little Link” To Ethereum Use Cases, Says Smart Contract Inventor

- Goblintown NFT Strategy Goes Live – Its Daily NFT Sales Jump +1,700%

Nhận xét

Đăng nhận xét